Broadridge Repo Market Data

Aggregated metrics from Broadridge's DLR platform

Background

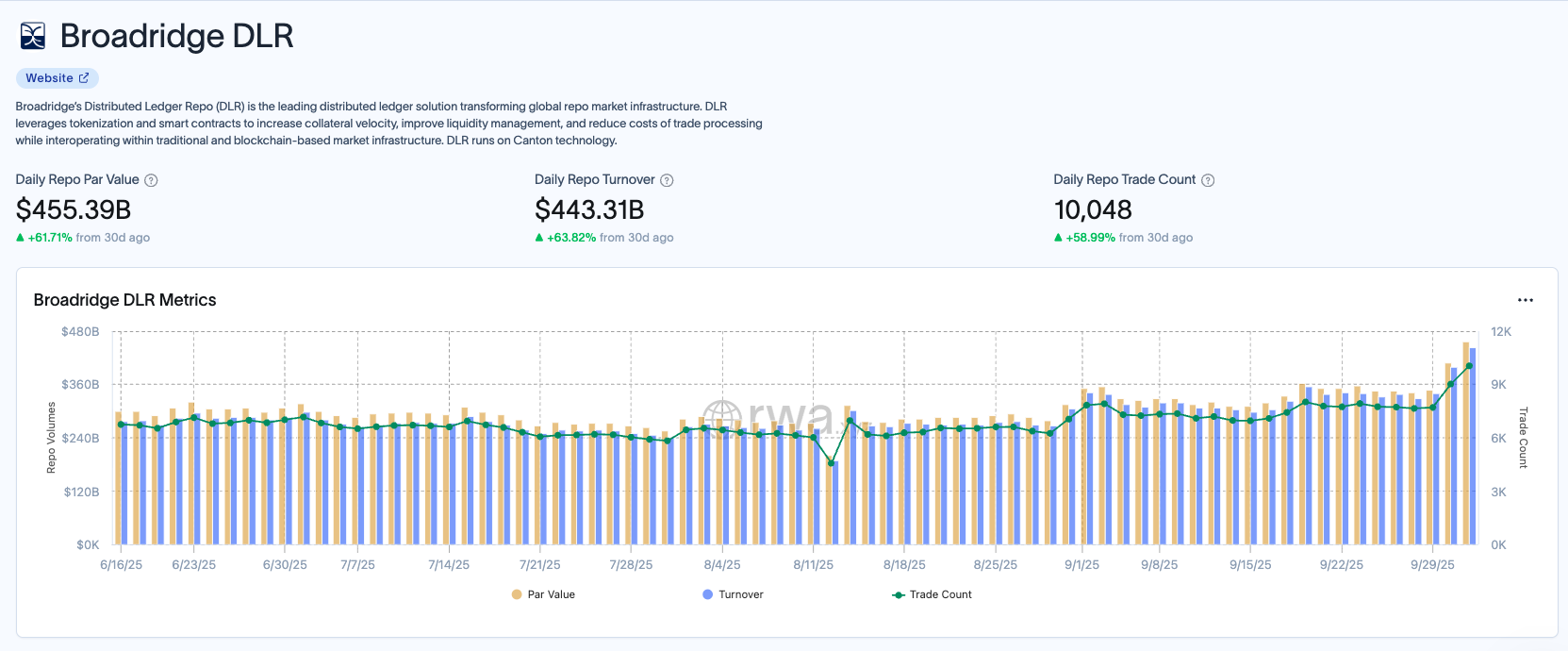

Broadridge's DLR platform processes over $280 billion in daily repo transactions, representing the world's largest institutional platform for settling tokenized real assets. The platform has experienced remarkable growth, with monthly volumes reaching $5.9 trillion, up from $4 trillion earlier this year, underscoring significant market adoption and the transformative potential of blockchain technology in capital markets.

The Application

Leveraging Data Off-Ramp, this API delivers aggregated metrics from this massive repo market accessible to institutional subscribers. The distributed data includes daily and historical repo par value, repo turnover, and repo trade count, providing critical insights into this vital segment of fixed income markets.

Using Data Off-Ramp for this provides several advantages:

IP Protection

Data integrity and intellectual property rights are maintained through dedicated audit access and controlled processing.

Data Segregation

Broadridge data operates in a dedicated, technically segregated infrastructure protected against unauthorized access.

Compliance Standards

All data processing is conducted under SOC 2 Type II standards with independent audits.

Access Control

Carefully managed access with dedicated API keys and licensing verification.

On-Chain Revenue

Subscriptions and payments handled directly on Canton Network, enabling transparent revenue distribution.

See the Data in Action

Explore the data on the RWA.xyz dashboardInterested in this application?

If this application interests you and you'd like to discuss something similar for your organization, get in touch.

Get in Touch